On prediction market usability, the simExchange style

Alex Kirtland’s UsableMarkets has published its usability review of the simExchange. Please check it out. UsableMarkets is a blog focused on prediction markets from a usability perspective. There is a lot of great stuff there if you are interested in learning more about prediction markets. Also see Kirtland's earlier article on the simExchange as a prediction market focused for specific applications.

Stocks vs Futures

UsableMarkets kicks off the review with the ongoing discussion among the academic community regarding using stocks verse futures in a prediction market. As you know, the simExchange video game stock market lists stocks for upcoming video games that relate to the total copies a game will sell over its lifetime, similar to how real stocks relate to the total income a company will earn over its lifetime (the net present value of free cash flows, of course). These are different from futures that represent risk over a discrete time period (for example a contract that will expire next Friday and cash out).

UsableMarkets makes two points, that game stocks are (a) hard to predict because the lifetime of a game is unknown at the IPO and that (b) “when a game nears the end of it’s life span, trading will necessarily fall off.”

On point (a), just because something is difficult, I don’t think it shouldn’t be attempted. The number of copies a game will sell over its lifetime, over the next 4 months, this month, this week, or today are all useful data points. Ascertaining such predictions requires analyzing the same evidence and using the same lines of reasoning. Certainly there is a larger margin of error when predicting events further out, but the goal is better relative performance. Can trading on the simExchange predict lifetime sales better than another method?

I also believe gamers think of game sales in terms of lifetime sales. People remember that Halo 2 sold over 7 million copies. They don’t remember how many copies it sold between months 2 and 4 of release. They are thinking Halo 3 as an 8 million copy seller, not a 3 million copy seller between weeks 3-6 of release.

As for point (b), this has been the intention of the simExchange. Once a game nears the end of the lifespan and the total global sales has been predicted to a certain degree of accuracy, there is no longer a need to continue trading it. When the lifetime sales of a game is fully priced into a stock, players will cash out and turn their attention to new games in the same way growth investors cash out of mature companies by selling their shares.

An important premise to note is that part of the simExchange’s goal is to provide an entertaining stock market game that is also educational. My hope is that the simExchange will provide a realistic exposure to gamers and interest them in learning more about investing. This principle of education has been the core to the simExchange design.

This is part of the reason stocks on the simExchange are called “stocks.” When we launch a derivatives market for options and futures, we will call them “options” and “futures.” Probably a rumor slightly overshadowed by the black Xbox 360 Elite, but yes a derivatives market on the simExchange is coming. Remember: stocks do not expire and cash out on a regularly scheduled basis. Futures and option contracts do.

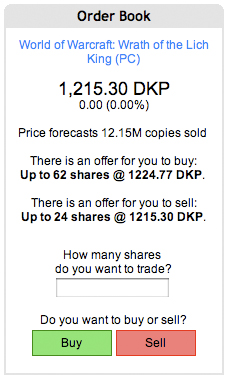

Order Book

UsableMarkets moves on to review trading on the simExchange, applauding the inclusion of basic and advanced trading modes as Midas Oracle also noted. However, Kirtland questions the wording of available offers on the basic trading mode, noting it may be confusing to present the order book concept in non-order book form.

This goes back to the educational aspect of the simExchange. Understanding that many players have no trading experience whatsoever, they may have no idea what is an order book. More commonly, the confusion for players is how prices and quantities come about for them to buy and sell. “How come I can only buy 499 shares at 823.76 DKP? Why 823.76 DKP? And why 499 shares?”

Many new players are unaware that markets work through the bids and offers of traders in a market place and that such bids and offers are then organized in an order book. I believed it is more clarifying for players to understand that they can buy and sell at certain prices and quantities because another player is offering that to them. This empowers players with the correct knowledge that prices are determined by market demand and not by pre-cognizant gnomes, robots from the future, or supernatural forces.

Furthermore, I don’t think it is confusing for a player to be presented choices in order book terms when they aren’t looking at a standard Level II Quotes order book because most players don’t know what a standard Level II Quotes order book looks like (the order book you see if you enable Advanced Trading).

Short Selling

Next, UsableMarket notes that the simExchange has a very simple interface for short selling, but does not simplify the concept of short selling. Again, educational value dictates how the simExchange handles this issue. Short selling is borrowing stock and selling it, hoping to buy it back at a cheaper price later and pocketing the difference.

UsableMarket implies it would be simpler to create opposite contracts. But this wouldn’t be short selling anymore. Imagine if players told their broker they wanted to short sell by buying opposite stocks because that is how they did it on the simExchange. Short selling is different from buying a put option or writing a call option—these concepts should not be confused and we would not be doing players any favors by mixing them up. I do not believe short-selling should be simplified at all as it is as fundamental as buying. People should be informed that short selling is a legitimate action to take in their investing, especially for the purpose of mitigating risk.

Trade confirmations

“Are you sure you want to buy?” The simExchange had played with this idea early on but players thought they would just be annoying. Many players fire off numerous trades in a minute from their portfolio page and can’t have some noobie warning cramping their style. My own philosophy is that a confirmation should only pop up if the player is taking a rare and possibly damaging action. Trading, however, is one of the most common actions a player will do on the simExchange.

-

Discussion - Submit a comment

Unable to retrieve yesterday\'s rank